Third Quarter Forecast And Opinion

,The first half was notable because the tariff chaos, due to the current administration’s trade policies, caused a 20% selloff in the stock market before Wall Street dismissed them as not to be taken seriously.

At the time of this writing, Trump tariffs continue to evolve outrageously, with diminishing impact on the stock market. The imposition of a 50% general tariff on the imports of Brazil, for example, as a punishment against the people of Brazil for their judicial treatment of former president Jair Bolsonaro, raises eyebrows considering that the U.S. has run a trade surplus with Brazil for 18 years. The sudden lack of volatility can only be explained by the fact that hard economic data has not yet caught up with tariffs, or that tariffs will not exist for long, or that Trump himself may not be around for long. According to the (nonpartisan) Tax Foundation, the current Trump program of tariffs will bring $2 trillion in revenues to the Federal government over the next ten years, and reduce US GDP by 0.8% before foreign retaliation. While the Trump administration is selling this as revenue coming from other nations, it will largely be derived from American consumers in the form of higher prices. Ultimately tariffs will prove to be a tax on the American people. The outcome of tariff negotiations will play an important role on the direction of markets in the second half of 2025.

One undeniable trend in the first half of this year was the decline of the US dollar, which lost 10% against other world currencies and 15% against the Euro. This is being interpreted as a re-assessment of “US exceptionalism”, and is happening for several reasons:

- Trump’s tariffs have created animosity among foreign bondholders, who continue to sell their US Treasury holdings. In the first four months of the year, China sold $110 billion in Treasury bond holdings. In the subsequent six weeks, it sold four times that amount Additional data will be about in several weeks, and it is likely to show further acceleration.

- Anticipation over lower US short term interest rates into slowing economic conditions are driving the dollar lower, driving further foreign selling of US Treasuries.

- Increasing foreign concerns over the wobbly US government finances is leading to an exodus out of US Treasury holdings by foreign central banks.

Foreign investment in the US stock market is at its historical high (18%), but could be pressured if foreign investors perceive that the USD will continue to fall any further.

Economists estimate that growth in consumer spending, which accounts for more than two-thirds of economic activity, was for last quarter tracking at a 1.5% annualized rate after slowing to a 1.6% annualized pace in the first quarter.

The Atlanta Fed is forecasting GDP rebounding at a 3.5% annualized rate in the second quarter. The anticipated surge will largely reflect a reversal in imports, which have fallen sharply as the frontloading of goods fizzled prior to the imposition of Trump tariffs. The economy contracted at a 0.2% pace in the January-March quarter.

Downside risks to consumer spending are, however, rising. The labor market is slowing; student loan repayments have resumed for millions of Americans and household wealth has been eroded amid tariff-induced stock market volatility. Overall economic uncertainty may be leading to precautionary saving.

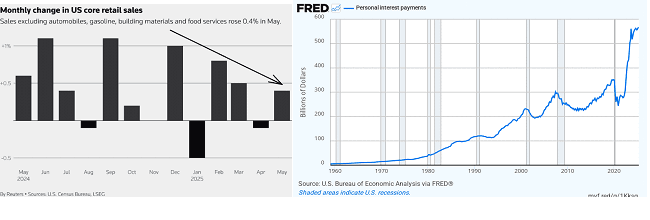

Consumers have been cautious since the beginning of the year. The top 20% of earners account for 50% of US consumer spending, and have been driving marginal US consumption, but as demonstrated by LVMH’s recent profit warning, softness in US and Chinese consumers has led to a weaker outlook. “Buy now/pay later” companies, like Klarna, are publishing an alarming rise (17%) rise in loan losses. Until very recently, US Federal student loan borrowers had access to various broad and targeted relief programs, but much of this relief has now been rolled back as of mid-2025. 2 million student loan borrowers are presently facing wage loan garnishing from their checking accounts, and the Dept. of Education estimates that number to rise to 10 million over the next ten months. As soon as these wages are garnished, they show up on credit reports and result in even higher interest costs. Below left, please find the monthly change in in retail sales over the past year, and at right, personal interest payments by Americans:

On July 4th, Congress passed its fiscal bill into law (preposterously called “The One Big Beautiful Bill Act”).

The bill is pro-growth, but will add to the deficit by around $2 trillion. Treasury Secretary Scott Bessent argues that we will grow our way out, but the bond market is sounding alarms again, because there seems to be no end to the annual budget deficits in sight. While tariff policies are driving down the value of the dollar, and antagonized foreigners, (who own 30% of our Treasury bonds), are either selling or are not buying any more Treasury bonds at a time when the US needs them to buy more of them, the US has a problem.

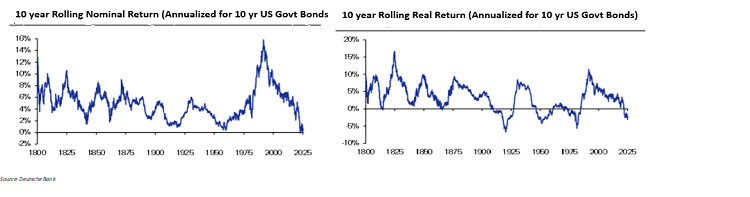

Thus, the bond market is the existential threat to the US economy. In nominal terms, this has been the worst five- or ten-year period for 10-year bonds since the beginning of the country’s history. On a “real” basis, or on an “inflation adjusted” basis, it has not been quite as bad as the 1970’s or after WWI, but it looks like its going to arrive there soon:

Credit card delinquencies are currently at an all-time high. While the pro-business approach of the Trump administration may have admirable ambitions, it offers little relief from 23% credit card rates, 7% mortgage rates, and 7-9% prime auto loan rates The futures market is anticipating only one interest rate cut between now and the end of the year. But the fear in the bond market is that long term interest rates may not move down if short term interest rates are cut. Because of fear of tariffs. Because of fear over ever-growing deficits. Because of fear over how to finance those deficits. The “Big Beautiful Bill” was designed to stimulate growth to attempt to grow the economy out of the deficit, but so far, the 10-year bond yield has not come down at all. Monetary policy and its use of the Fed Funds rate to steer the economy may be less impactful now than fiscal stimulus, and quantitative easing will be needed to hold long term rates steady and avoid a breakdown in the bond market at a time when fiscal stimulus would normally push long term rates considerably higher. The result of further money printing will lead to an even further decline in the US dollar which has already declined by 10% this year.

This is a 20-year chart of the ten-year US Bond yield. The black horizontal line represents a yield of 5%. The last time we saw a yield of 5% on the US ten-year bond was in the second half of 2007, just before the US economy saw a downturn:

The June Consumer Price Index came out today, and tariffs are starting to put upward pressure on prices. The annual core CPI rose to 2.9% from 2.8% last month, and core goods rose 0.5%, the most since June 2022, especially for imported goods. Increases in the list price of automobiles at the end of June suggested that the CPI number will increase again in July. This is far from the Fed’s target of 2%, and implies that the Federal Reserve is no position to cut interest rates anytime soon, and may even remain in neutral for some time.

President Trump has recently alluded to prematurely naming a new Fed Chairman nine months early, since the current Chairman, Jerome Powell, is not finished with his term until mid-May 2026. Trump’s gambit relies on naming an obedient and subservient Fed Chairman that would maximally cut rates to bolster the economy and reduce the debt burden of the government without concern for inflation. It should be noted that interest rate decisions are made by a committee of 12 Fed members to are all seemingly loyal to Jerome Powell, who will remain on the Fed Board at the end of his tenure as Chairman. While the stock market may, on a short-term basis, celebrate any such announcement, the worry is that the bond and currency market would revolt at any sign that the Federal Reserve has lost its independence.

For the first half of 2025, the S&P 500 index was up 5.5%, the Dow was up 3.6%, and the Nasdaq was up 5.4%..

Wishing you a pleasant summer!

Grant Rogers

Metis Capital Management LLC

GLOBAL DISCLAIMER: THIS REPORT HAS BEEN PREPARED BY METIS CAPITAL MANAGEMENT LLC. THIS REPORT IS FOR DISTRIBUTION ONLY UNDER SUCH CIRCUMSTANCES AS MAY BE PERMITTED BY APPLICABLE LAW. IT HAS NO REGARD TO THE SPECIFIC INVESTMENT OBJECTIVES, FINANCIAL SITUATION OR PARTICULAR NEEDS OF ANY SPECIFIC RECIPIENT. IT IS PUBLISHED SOLELY FOR INFORMATIONAL PURPOSES AND IS NOT TO BE CONSTRUED AS A SOLICITATION OR AN OFFER TO BUY OR SELL ANY SECURITIES OR RELATED FINANCIAL INSTRUMENTS. NO REPRESENTATION OR WARRANTY, EITHER EXPRESS OR IMPLIED, IS PROVIDED IN RELATION TO THE ACCURACY, COMPLETENESS OR RELIABILITY OF THE INFORMATION CONTAINED HEREIN, NOR IS IT INTENDED TO BE A COMPLETE STATEMENT OR SUMMARY OF THE SECURITIES, MARKETS OR DEVELOPMENTS REFERRED TO IN THE REPORT. THE REPORT SHOULD NOT BE REGARDED BY RECIPIENTS AS A SUBSTITUTE FOR THE EXERCISE OF THEIR OWN JUDGMENT. ANY OPINIONS EXPRESSED IN THIS REPORT ARE SUBJECT TO CHANGE WITHOUT NOTICE. THE ANALYSIS CONTAINED HEREIN IS BASED ON NUMEROUS ASSUMPTIONS. DIFFERENT ASSUMPTIONS COULD RESULT IN MATERIALLY DIFFERENT RESULTS. THE ANALYST RESPONSIBLE FOR THE PREPARATION OF THIS REPORT MAY INTERACT WITH TRADING DESK PERSONNEL, SALES PERSONNEL, OTHER ANALYSTS, JOURNALISTS, AND OTHER CONSTITUENCIES FOR THE PURPOSE OF GATHERING, SYNTHESIZING AND INTERPRETING MARKET INFORMATION. METIS CAPITAL MANAGEMENT LLC IS UNDER NO OBLIGATION TO UPDATE OR KEEP CURRENT THE INFORMATION CONTAINED HEREIN. THE SECURITIES DESCRIBED HEREIN MAY NOT BE ELIGIBLE FOR SALE IN ALL JURISDICTIONS OR TO CERTAIN CATEGORIES OF INVESTORS. OPTIONS, DERIVATIVE PRODUCTS AND FUTURES ARE NOT SUITABLE FOR ALL INVESTORS, AND TRADING IN THESE INSTRUMENTS IS CONSIDERED RISKY. MORTGAGE AND ASSET-BACKED SECURITIES MAY INVOLVE A HIGH DEGREE OF RISK AND MAY BE HIGHLY VOLATILE IN RESPONSE TO FLUCTUATIONS IN INTEREST RATES AND OTHER MARKET CONDITIONS. PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS. FOREIGN CURRENCY RATES OF EXCHANGE MAY ADVERSELY AFFECT THE VALUE, PRICE OR INCOME OF ANY SECURITY OR RELATED INSTRUMENT MENTIONED IN THIS REPORT. METIS CAPITAL MANAGEMENT LLC ACCEPTS NO LIABILITY FOR ANY LOSS OR DAMAGE ARISING OUT OF THE USE OF ALL OR ANY PART OF THIS REPORT. CERTAIN OF THE INFORMATION CONTAINED IN THIS PRESENTATION IS BASED UPON FORWARD-LOOKING STATEMENTS, INFORMATION AND OPINIONS, INCLUDING DESCRIPTIONS OF ANTICIPATED MARKET CHANGES AND EXPECTATIONS OF FUTURE ACTIVITY. METIS BELIEVES THAT SUCH STATEMENTS, INFORMATION, AND OPINIONS ARE BASED UPON REASONABLE ESTIMATES AND ASSUMPTIONS. HOWEVER, FORWARD-LOOKING STATEMENTS, INFORMATION AND OPINIONS ARE INHERENTLY UNCERTAIN AND ACTUAL EVENTS OR RESULTS MAY DIFFER MATERIALLY FROM THOSE REFLECTED IN THE FORWARD-LOOKING STATEMENTS. THEREFORE, UNDUE RELIANCE SHOULD NOT BE PLACED ON SUCH FORWARD-LOOKING STATEMENTS, INFORMATION AND OPINIONS.

Posted on 07/15/2025 at 10:40 AM