Fourth Quarter Forecast and Opinion

The U.S. Supreme Court will hear oral arguments on the legality of Trump’s sweeping global tariffs on November 5, which will prove important to markets as a test of the US Presidents use of his executive power to drive his economic agenda through the International Emergency Economic Powers Act. If the tariffs are found to be illegal, the nonpartisan Committee for a Responsible Federal Budget estimates that it will cost the US government $2.2 trillion by 2035, and push U.S. debt-to-GDP to 126 percent from their current baseline scenario of 120 percent. It should be noted that S&P, the ratings agency, recently affirmed a “stable” outlook to the U.S. credit rating because they feel that tariff revenues will offset the Trump tax cut and spending bill. S&P also warned of a downgrade in the credit rating of the U.S. if federal deficits continue to rise.

At the time of this writing, the Federal government shutdown has lasted 16 days, and is expected to continue for the foreseeable future. While around 25% of total government spending is impacted by the shutdown, markets are treating it as a non-event, at least so far. The federal government is using the shutdown as an opportunity to reduce the federal workforce. Each week of shutdown is estimated to cost overall quarterly GDP by 0.1 to 0.2% of GDP per week, although typically this comes back in the following quarter when federally employees receive their back pay.

AI Rally:

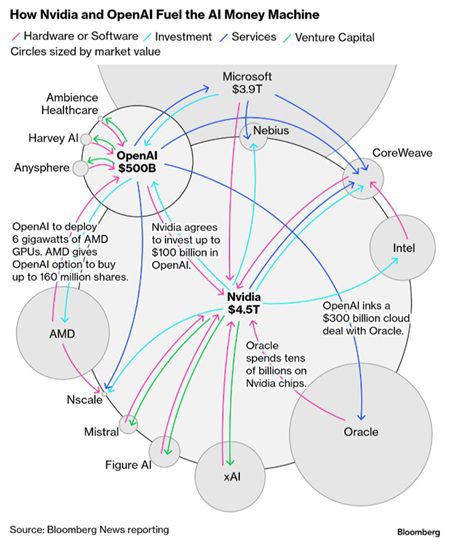

The AI driven rally continues apace, and is to a degree, in a self-reinforcing feedback loop. Many “mega” deals have taken place recently between the largest players in artificial intelligence, involving chips, GPU’s, data centers, and cloud infrastructure. Vendor financing within this industry has become a concern for Wall Street, as companies like Nvidia have begun financing their own clients such as Open AI ($100 billion), xAI ($20 billion), Oracle’s $300 billion cloud infrastructure deal with Open AI, a $10 billion partnership between Open AI and chipmaker Broadcom, among many others. Vendor financing was a significant contributor to the late 1990’s internet and telecom bubble. The chart below demonstrates the “circularity” of the AI economy, fueling concerns that the spending in this sector is causing the stock market to overheat. The market’s tug-of-war for the foreseeable future will be the weighing of how much capital has been expended on AI (between $1.5-$3 trillion), and what sort of returns have come from it ($300-$600 billion). Sam Altman, the CEO of Open AI, said recently that over the coming few years, “trillions” more need to be spent on AI infrastructure, and pledged to spend $1 trillion more on Open AI’s infrastructure. Considering that the current annual revenue of Chat GPT is only $10 billion, some worry that the costs associated with AI will be too great for the profits that may come from it. AI infrastructure, chips, and data centers are expensive to run, and chip technology is evolving very quickly, data centers may depreciate and need upgrading faster than they can generate revenues. While AI is growing exponentially, it is unclear that current capital expenditures will ever be justified by future profits.

Another impact of the “AI revolution” is the weight of tech giants within the S&P 500. Nvidia alone accounts for than a third of the S&P index’s gains this year. Nvidia now has a market capitalization of $4.5 trillion, and represents 7.2% of the index, which is weighted according to the market cap of its constituents. The so called “Magnificent seven” represent 34.5% of the entire S&P 500, leading to heretofore unknown levels of concentration risk.

Rare Earth Showdown:

China processes 85-90% of the world’s rare earth metals, and close to 99% of “heavy” rare earth metals.

These elements are all found on the bottom row of the periodic table, and have been in the news recently because of the collective realization that China has control over the entire market for them. They are used in all consumer, commercial, and defense electronics. Light rare earth elements are more abundant, and are used in mass market tech, strong magnets, aircraft engines, electric vehicle motors, wind turbines, smartphones, TV and computer screens, nuclear reactor control rods, hard drives, and scientific instruments, among many other things. Heavy rare earth metals are used for magnets, lasers, phosphors, and defense technologies like F-35 fighters, Aegis destroyers, and advanced missile guidance systems. They are rarer, harder to separate, and mostly found in southern China’s ionic clay deposits — hence China’s near-monopoly on heavy rare earth metal refining.

The federal U.S. government has begun taking stakes in domestic rare earth element (REE) mining companies out of fear that China will weaponize its dominance in the industry. Certainly, the realization of that dominance is beginning to impact Trump tariff policies toward China, as the U.S. administration comes to realize that, in this important industry, China “holds all the cards.” China imposed export restrictions to the U.S. last week, in retaliation to new U.S. tariffs. The U.S. strategic stockpile of rare earths is estimated to only last from several weeks to a few months. China has over a dozen doctorate programs focusing on rare earth metals, and over 300,000 people professionally focused on them. In the U.S., there are no doctorate programs, and less than 500 people working professionally on producing REE’s.

This is explained through several things. REE’s tend to be found in geological areas where thorium and uranium are found. Processing REE’s becomes less profitable when a miner must then dispose of thorium and uranium, which is considered toxic and is expensive to dispose of. The economics of processing REE’s are thus less compelling in a capitalist environment, as opposed to in an environment like China’s where state run companies are also focused on long range national interests. Furthermore, U.S. regulations concerning thorium and uranium are much stricter than in China, making disposal of these two elements cumbersome in the mining process. In processing and refining of REE’s, the U.S. is estimated to be 15-20 years behind Chinese capabilities, given that country’s established infrastructure and technological advancements.

Federal Reserve Monetary Policy:

On September 17, the Federal Reserve lowered its benchmark interest rate by 25 basis points to a target range of 4%-4.25%. This was to support the labor market amid concerns about slowing economic growth, even as inflation remained a concern. The Fed has signaled that there may be more interest rate cuts forthcoming, as labor market deterioration is leading to negative job growth. Unemployment rose to 4.3% in August, the highest level since 2021.

Signs of Stress in the Credit Market:

The September bankruptcies of First Brands Group, a U.S. auto parts supplier, and Tricolor Holdings, a subprime auto lender, have highlighted cracks in the credit market which has led to some top financiers warning about an erosion in lending standards. JP Morgan CEO Jamie Dimon suggested that these defaults could be due to broader credit risks in the economy. Delinquencies in subprime auto loans have reached historic highs, leading to increased yields on auto loan-backed bonds as investors demand higher returns for perceived risks. The impact on regional banks that financed these firms is taking a toll on their stock prices and evoking questions about loan underwriting standards and credit risk controls. Banks may become more conservative in lending to certain types of borrowers as a result.

Consumer Spending

We are in a “K” shaped economy with respect to the American consumer. The top 20% of income earners are spending 50-60% of all consumer expenditures, while the bottom 80% account for the rest, according to the BLS and the Fed. The most recent (Oct. 15) release of the Fed “Beige Book” portrayed an economy that is barely growing. “Economic activity changed little on balance since the previous report, with three Districts reporting slight to modest growth in activity, five reporting no change, and four noting a slight softening.” The Fed also noted a softening in the overall employment outlook: “In most Districts, more employers reported lowering head counts through layoffs and attrition, with contacts citing weaker demand, elevated economic uncertainty, and, in some cases, increased investment in artificial intelligence technologies.”

GDP for 2025 is forecast to be somewhere between 1.7% and 2%, suggesting a slowdown in the economy relative to 2024. The market’s recent strength is based upon the expectation of further reductions of interest rates by the Fed, just as tariffs and government debt may increase inflation and prevent the Fed from lowering rates further. While stocks are historically expensive, earnings growth at S&P 500 companies are robust. In a healthy economy, S&P 500 earnings grow between 5-10% per year. Analysts are expecting 12% growth this year, and some foresee 13% corporate margins should be above average this year as well at 12-13%. Until unemployment begins to accelerate, stocks will remain underpinned by the expectation of rate cuts in 2025 and 2026, AI-related infrastructure spending, and corporate profits, unless signs of tariff related inflation begin to appear.

Grant Rogers

Posted on 10/15/2025 at 08:02 AM